Your Mobile Digital Engagement Solution. Smarter Apps. Smarter Marketing.

Bryj unifies Mobile Apps, Analytics & Engagement, and AI-driven Marketing Campaigns—all in one powerful mobile-first data-driven product suite.

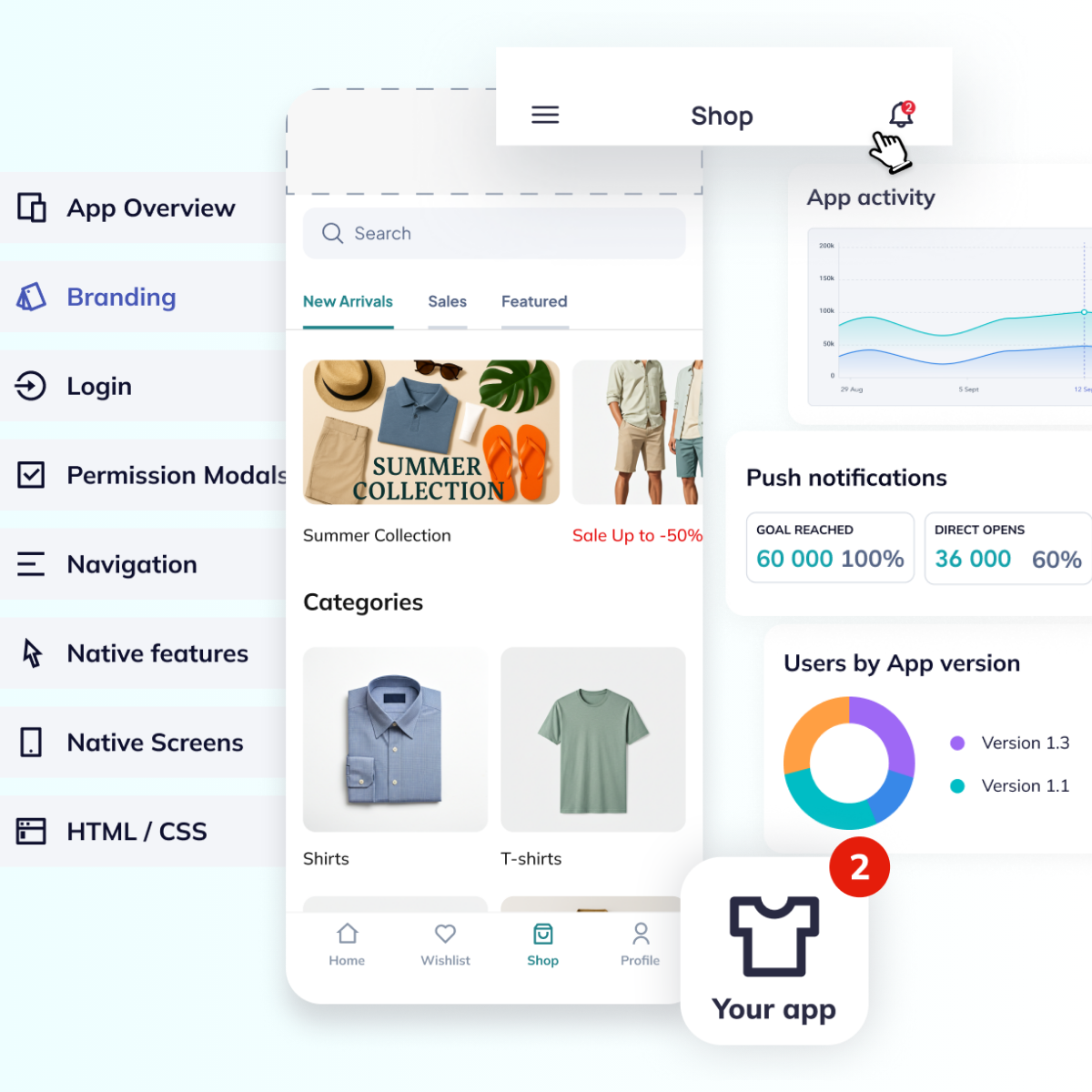

Drive Loyalty, Conversions, and Revenue with Mobile Apps

Mobile apps consistently outperform websites in key metrics, delivering a faster, more engaging experience. With 2x the engagement and 5x higher conversion rates than mobile web, apps allow you to offer a superior user experience that drives higher revenue. Bryj’s no-code tools enable rapid app development—up to 5x faster than traditional methods—without sacrificing quality or scalability.

Features:

Powered by cutting-edge technology and designed for peak performance

Create Personal Experiences that Boost Engagement and Retention

Mobile apps are unmatched in driving user retention and long-term value. You can keep users active and loyal by using real-time data to personalize experiences and adjust engagement strategies. With push notifications, in-app messages, and predictive analytics, Bryj helps you drive customer engagement.

Features:

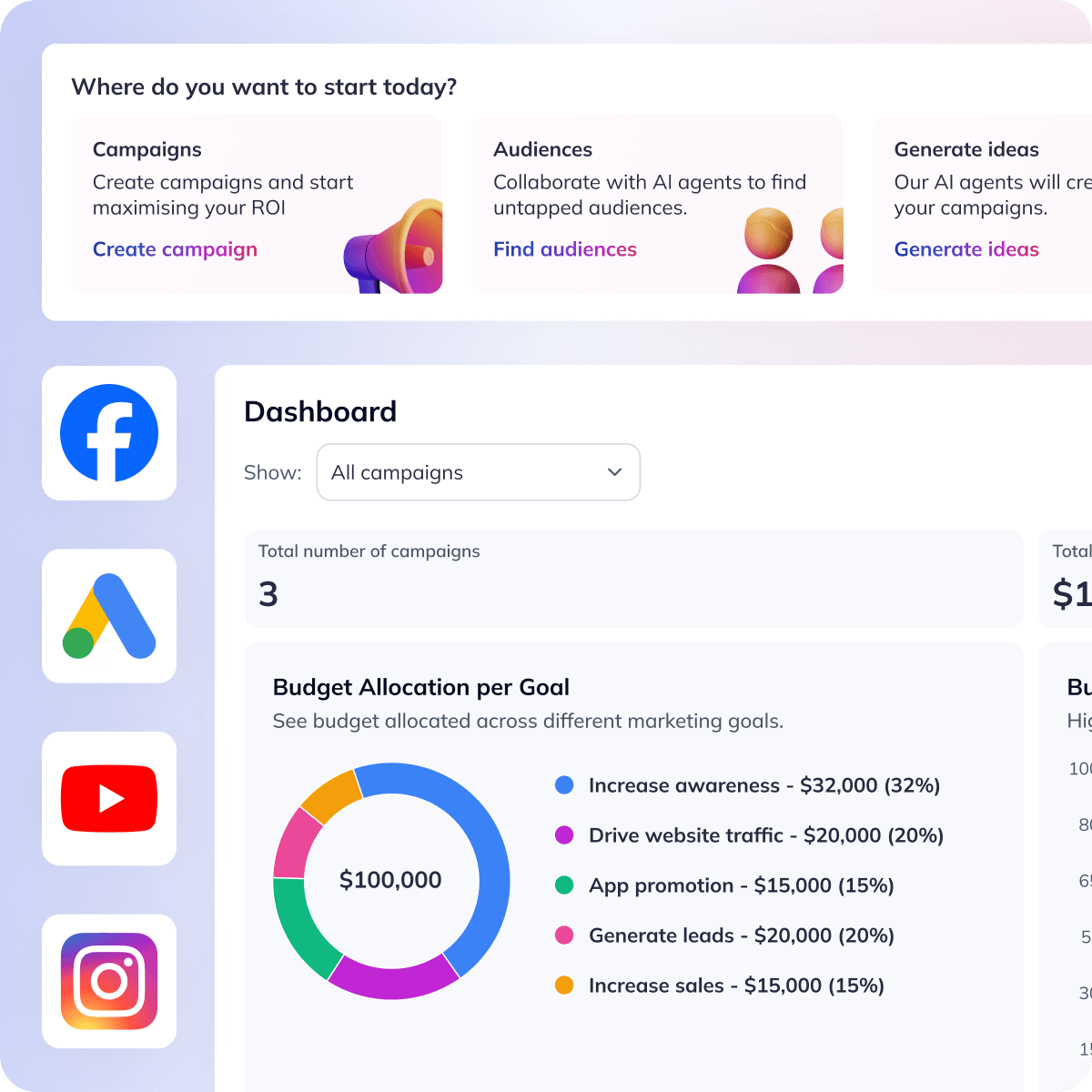

Start with a tool, scale with a team.

Don’t know where to start? Let ChatROI guide your audiences, ads and media plan with the best marketing strategy aligned with your brand.

AI Agents turn your goals into a cross-channel strategy by recommending the right media channels from Meta and Google to influencers.

ChatROI. Marketing strategy made smarter.

Your marketing strategy amplified by AI – discover audiences, build ads and comprehensive media plans in minutes.

Autonomous Ad Campaigns

Digital Advertising

AI Campaign Optimization

Mobile Apps

Mobile Native Notifications

Campaign Analytics

Autonomous Ad Campaigns

Digital Advertising

AI Campaign Optimization

Mobile Apps

Mobile Native Notifications

Campaign Analytics

Autonomous Ad Campaigns

Digital Advertising

AI Campaign Optimization

Mobile Apps

Mobile Native Notifications

Campaign Analytics

Bryj Powers Every Stage of the Mobile Journey

At Bryj, AI isn’t a feature—it’s the foundation. From app launch to lifecycle marketing, our platform intelligently guides each user through your mobile funnel with precision.

Whether you’re acquiring new users, activating them with personalized onboarding, or re-engaging them through data-driven campaigns, Bryj combines Mobile Apps, Engagement Analytics, and ChatROI to maximize ROI across every stage of the funnel.

Bryj Blog

From Insights to Engagement: Building Smarter Mobile Strategies with Bryj

Building smarter mobile strategies starts with insight and ends with engagement. Bryj empowers businesses to…

Why ChatROI Is the Partner Every Team Needs

ChatROI simplifies how marketing teams plan and optimize campaigns. Built by Bryj, it combines AI-driven…

The New Metrics That Define Mobile App Success in 2026

In 2026, app success is redefined by precision and long-term value. Learn the new performance…